上海振宇高新技术开发有限公司是一家开发、生产、销售、安装、工程服务、售后于一体的制冷设备公司。公司公司专业生产:冰水机、速冻冷藏冷库机组、氨机改造机组、螺杆式冷水机组、中低温冷水机组、反应釜冷水机组、制冰机组、风冷冷水机组和冷却塔等产品,能为各行业提供整体制冷解决方案。

25年

冷热设备研制经验20+个

产品覆盖城市8个

全国产品售后网点1000+家

服务企业

精选国外原材料,标准化工艺,严控品质;冷水机组及配套选型更加合理、好用、节能

上海振宇高新技术开发有限公司25年1000+企业服务经验积累,为您提供针对性的解决方案,给您带来更高价值

乳制品、饮品生产过程中往往需要加热后迅速冷却,要求冷水机组的钢管路、水箱、水泵材质为不锈钢以满足卫生要求。

了解更多 >

如何提高塑料产品质量和稳定性是塑料行业的重要课题,针对塑料机械而言解决了生产设备的冷却水温恒定问题, 防止水温过高或过低影响产品质量从而导致产品变形造成严重的经济损失。

了解更多 >

反应釜专用冷水机,温度控制范围为7℃— -35℃,广泛应用于化工反应釜领域,对反应釜内部的化学反应及物理反应产生的热量进行迅速冷却

了解更多 >

电镀 电泳涂装、阳极氧化(氧化铝)、镀铬、镀锌、镀镍等。利用电化学原理使被镀物件表面镀上特殊金属层或涂层。在此过程中被镀液进行直接或间接冷却,从而提升产品质量和工作效率。

了解更多 >

优势一:技术力量

优势一:技术力量拥有一支高技术水平的研发队伍、资深工程师组成的研发团队

重金科研投入,人才培养与引进,大胆创新,已研发1000多种型号产品,并获得近百项产品专利。

根据需求定制不断开发新的工艺,引入新的技术,为客户设计、订制各种个性化产品,按时出货,定制周期有保证。

深耕行业 细分领域 满足客户更多需求

优势二:产品和工艺

优势二:产品和工艺原材料选用世界知名品牌,经层层把关,为客户提供优质的产品

官方认证品牌,践行质量即信誉,严控设备出厂关,以产品质量赢得好口碑。

标准化生产工艺,赋能价值国际化生产流程管理,质量可靠,严格遵守正规生产流程(好品质=规范生产+严格管控)

产品久经市场考验,检测报告书,质量保障

现场勘察

现场勘察

派遣专业的技术人员去现场斟查条件,充分了解客户需求

设计方案

设计方案

由资深工程团队,快速设计选配合适的设备方案,优化客户成本

精密生产

精密生产

现代化生产工艺流程,上百个工序质量严格把关,出厂前经国家认可的检测系统进行各项指标检测

安装调试

安装调试

对客户所做的工程进行免费调试,提前沟通安排调试时间,安排调试人员到达现场进行调试

现场培训

现场培训

免费为客户培训机组操作人员、维护人员,便其能够独立维护、操作、保养设备机组

售后服务

售后服务

定期上门巡查,专职团队长期跟踪。保修期内如有问题,24小时内赶赴现场,免费维修,及时解决

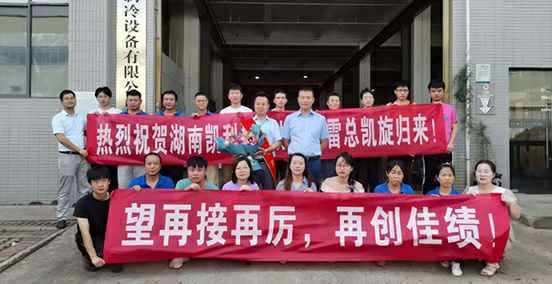

热烈庆祝我司山东办事处雷总斩获千万级冷库大单,客户经过多家同行方案,报价对比,再结合我司众多合作客户实地走访考察询问冷库效果,节能降耗等因素最终确定合作关系。

查看详情 +上海振宇高新技术开发有限公司所有员工给雷总庆祝生日,祝愿雷总青春常驻,笑口常开,生日快乐!健康幸福!

2020-09-15 查看详情 +是时候展现一下我们公司在工业冷水机组方面的实力了!五月旺季,“上海振宇高新技术开发有限公司”公司大量螺杆机超低温机组正在持续生产中。“上海振宇高新技术开发有限公司”牌机组一直以来,由于适销对路,物美价廉,给长期合作的客户留下了不错的信誉,夏日炎炎,全国各地的订单纷至沓来。

2020-05-25 查看详情 +昨日,我公司开展了全国制药机械博览会,并邀请了全国制冷行业的各位领导及客户一行来我公司进行实地参观考察。领先的技术、优秀的产品和服务,雄厚的公司资质和信誉,良好的行业发展前景,是吸引此次各位领导及客户到访的重要原因。公司总经理刘总、技术部总监刘哥对此次到访的各位领导及客户表示热烈欢迎,并安排了细致的接待工作。在刘哥的陪同下,客户参观考察了公司生产车间,在公司冷水机组生产厂家技术人员的指导下,各位领导及客户现场进行试验操作,设备的良好性能令领导和客户啧啧赞叹!对客户提出的各类问题,公司技术人员均作出细致解答,丰富的专业知识和有素的工作能力,也为各位领导及客户留下了深刻印记。

2019-10-16 查看详情 +

螺杆式冷水机控制器根据自身的内部时钟或一组外部触点启动冷水机,控制器检查冷水机组的可靠性,并通过预启动延时程序提供正确的润滑油压力。 另外,预启动程序利用冷水机启动过程中的延时来启动冷冻水泵和冷却水泵,如果冷水机装有截止阀,则在启动冷却水泵之前应检查阀门位置(开/关)。

查看详情 +反应釜冷水机主要用于化学反应器(化学换热器)的冷却,及时带走化学反应产生的巨大热量,达到冷却(冷却)和提高产品质量的目的。

2016-01-14 查看详情 +智能冷库机组可以轻到几十公斤,重到几百公斤甚至几吨,所以对安装场地有一定的要求!因为智能冷库机组的重量很重,甚至需要吊机,所以要为智能冷库机组选择合适的承重地,需要空间独立与周围环境无杂物,良好的冷却通风条件,防晒防雨,环境不会太潮湿,易装修承重等方面。

2016-01-14 查看详情 +速冻机由压缩机、冷凝器、蒸发器、干燥过滤器、膨胀节流阀五部分串联组成,在其中注入适量的制冷剂,电器根据需要控制压缩机的运行环境以实现制冷和传热的目标。压缩机是一种将低压气体提升为高压的驱动流体机械,速冻机是制冷系统的核心,它从吸入管吸入低温低压的制冷剂气体,通过电机的运转带动活塞对其进行压缩,将高温高压的制冷剂气体排出到排气管中,为发动机提供动力制冷循环,从而实现压缩→冷凝→膨胀→蒸发(吸热)的制冷循环。

2015-12-23 查看详情 +